An upcoming ban on hemp-based THC drinks has sales buzzing.

Last fall, federal lawmakers moved to close a loophole that allowed beverage manufacturers to sell products with low doses of THC, the psychoactive component in cannabis. But news about the upcoming ban, set to take effect in November, has seemed to only add to the hype around the emerging industry.

Sales of Cann, a THC-infused sparkling water company,were up 40% month over month in the two months following the ban's announcement. January saw a similar month-on-month jump, Jake Bullock, co-founder and CEO of Cann, told Food Dive.

Bullock attributes the bump to the news coverage of the hemp ban getting the word out about Cann’s products, as well as some of its existing customers stocking up in advance of a clampdown, he said.

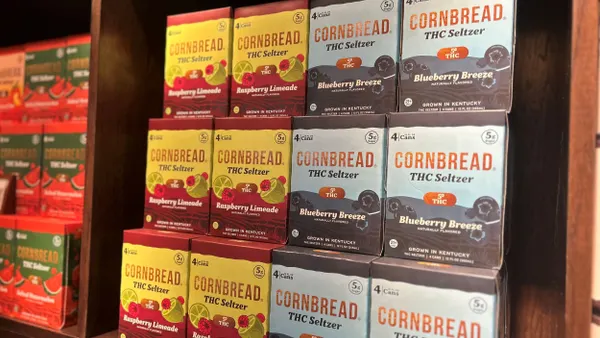

Cann isn't alone. Kentucky-based Cornbread Hemp saw a 31% increase in sales from the time the ban was announced to mid-December. And THC-infused spirit company Nowadays saw similar results, with a week-over-week sales increase of 38.8% and a 29.7% increase in average order value following the ban announcement.

The short-term boost to sales comes amid a larger expansion for the category, with more retailers and event spaces embracing the drinks.

The overall THC beverage category has grown 128% year over year, according to the most recent NIQ research. Kaleigh Theriault, director of beverage alcohol thought leadership for NIQ, attributes the rise to multiple different factors.

New brands and new items in the category are launching everyday, and retailers are carving out space for them on their shelves, she said. With both of these factors, it's harder to see any ban-induced jump in THC sales broadly. The expansion in retailers also shows that there is substantial demand for these products, and it isn't just a fad.

Retailers aren't just adding THC drinks to their assortment because "it's new and different," Theriault said.

“They’re doing it because the consumer is actually seeking these products out,” she added.

But if the ban ultimately did result in an industry-wide sales boost, it wouldn’t be surprising, Theriault said. She likened it to a boost in champagne sales following news of potential tariffs that would have raised prices, which caused consumers to load up in advance of the impact.

The sales boost and increased consumer awareness could help THC beverage manufacturers make their case to delay or rework the legislation into something more industry-friendly. Earlier this year, legislation was proposed to change the deadline to 2028.

Though THC beverage companies and analysts are watching the pending legal decisions, consumers are less aware of the changes, Theriault said.

“From a legal standpoint, I will say there’s probably a set of consumers that have no idea what’s going on,” she said. “They’re just trying the new products.”