UPDATE: July 20, 2021: Stryve Foods, the maker of air-dried meat products, said shareholders of Andina Acquisition Corp. III approved the merger between the two entities. The specialty purpose acquisition corporation changed its name to Stryve Foods Inc., with the new company's stock expected to begin trading on the NASDAQ on or about July 21. The company will continue to be led by Joe Oblas, co-founder and co-CEO, and Jaxie Alt, co-CEO and chief marketing officer.

-----

Jaxie Alt, the co-CEO and chief marketing officer of Stryve Foods, is decidedly upbeat when she says her company's air-dried meat products have the potential to disrupt the staid meat snack category, and Wall Street seems to agree. The challenge remains convincing U.S. consumers.

"We have an amazing product, but no one has heard of it," said Alt, who previously spent more than 17 years at the former Dr Pepper Snapple Group, where she served as co-chief marketing officer. "We got to market and drive awareness and get people to try it."

Now, Stryve Foods will reach the public markets as part of a merger with Andina Acquisition Corp. III, a specialty purpose acquisition corporation, that would value the company at $170 million — giving the three-year old healthy food upstart a cash infusion to grow its business and market its products against category leaders including Jack's Link. A separate group of private investors, including actor Channing Tatum and NFL quarterback Justin Herbert, are privately purchasing $42.5 million of common stock at $10 per share, which will close concurrently with the merger. The deal is expected to be completed in the second quarter.

A public offering marks the latest step for the fast-growing company founded three years ago. For much of its brief existence, its portfolio included its flagship product, Stryve, the top-selling biltong brand in the U.S. Last fall, it rolled out Vacadillos, a dried carne seca meat aimed at Hispanics who may not be familiar with its signature item. Then in mid-December it purchased Kalahari, the second biggest biltong brand, to further strengthen its dominant position in the category.

The protein snacks company posted a 63% compound annual growth rate in gross revenues since it started in 2018. The pace is expected to accelerate in 2021. Sales are expected to double to $51 million in 2021 as Stryve boosts its e-commerce presence, grows sales of its existing brands and adds more retail stores to the 20,000 locations where it is already carried.

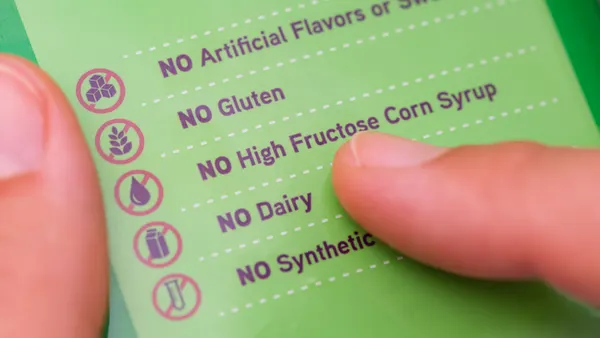

While the market for biltong remains largely untapped for most Americans, the offering is getting more popular among consumers looking to eat healthier. The process of air-drying meat — compared to cooking, as is done with beef jerky — creates a product that has up to 50% more protein per serving, the company said. Stryve’s meat snack products also eschew other ingredients shunned by many consumers, including sugar, MSG, gluten, nitrates, nitrites and preservatives.

Alt said meat snacks are the first product in Stryve's broader better-for-you snacking platform, which will eventually grow to include other offerings such as chips and crackers.

"We're not scared. Meat snacks is pretty competitive and we've figured out a way to play there in a highly differentiated way," she said. "That will be our same strategy: How do we figure out a way in with consumer insight and differentiated products that really is something compelling that makes consumers want to try us and fill in a need that is not there today."

The healthy snacks company is the latest of many food manufacturer to turn to a SPAC. Hostess Brands, which is now publicly traded, was acquired through this type of investment vehicle in 2016. And 100-year old snack maker Utz recently came public using a blank check deal. Indoor greenhouse operator AppHavest is expected to hit the public markets in the next few weeks following its own SPAC deal.

A blank-check company is created by an entity raising funds with the goal of merging or acquiring another business. For companies they acquire, it's usually a faster and cheaper way of going public.

Alt said the company decided to go public using a SPAC after meeting Andina executives because it was a much quicker way to raise cash than a traditional IPO or by being acquired by a larger CPG or private equity firm.

A handful of premium food manufacturers have tapped into the public markets on their own during the last year, including plant-based nutritional company Laird Superfood, plant-based food maker Modern Meat and Vital Farms, the largest producer of pasture-raised eggs. Others may join them this year. Plant-based egg maker and cell-based meat developer Eat Just and Swedish plant-based dairy titan Oatly have reportedly considered IPOs, though there is no timetable for when those could occur.

Alt said the success of these new entrants to the stock market bodes well for Stryve.

"When we look at this idea of bringing healthier snacks to America, I think [investors] understand, 'OK, I get what you are trying to do, we see where consumers are moving to and we think that the market will react favorably for what we are offering,'" Alt said. "That's what I think those other IPOs show us, is that the public markets understand."