The following is a guest post from John Broderick, VP of strategy and insights at packaging consultancy WovenWorks, formerly known as PV&COHO. Opinions are the author's own.

From grocery aisles to newsrooms to boardrooms, 2025 has felt like a year spent in the eye of a perfect storm. Prices zigzagged, tariffs surged and stalled, consumer sentiment hit recession-level alarms, and manufacturers faced a constant state of “wait and see.”

After studying these shifts closely for the past year, it's become clear that consumers aren’t tuning out, they’re more dialed in than ever. Their behavior is changing in ways that will reshape how CPG companies design, price, and position their products in 2026 and beyond.

Consumers Are Really Paying Attention

If last year was about economic fatigue, the coming years will be about economic vigilance.

In our research, more than 90% of Generation Z and Generation X said they’re highly tuned in to the economy, politics and global news. Tariffs, traditionally a back-page topic, are now part of household conversation. In sentiment surveys, consumers volunteered tariff concerns unprompted, linking them to rising costs of groceries and everyday goods.

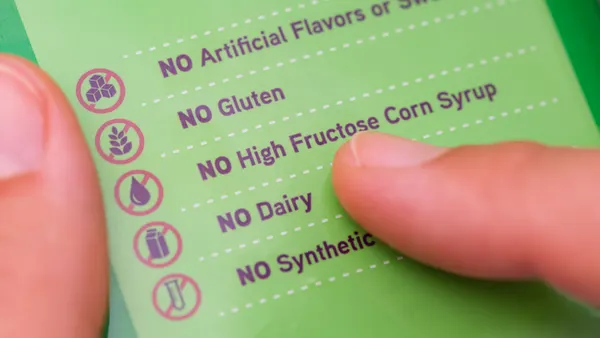

They’re not wrong: 75% of consumers expect tariff actions to push grocery bills higher. That perception alone shapes behavior, changing how people shop by becoming more price sensitive, rethinking their brand loyalty and questioning whether a brand is worth a premium price. Consumers are also expecting pack transparency, which could include sustainability and country of origin information.

Spending Isn’t Collapsing, It’s Reorganizing

Consumer sentiment is falling, and confidence is at its lowest point in a decade. Yet behavior tells a different story: people are still shopping, treating themselves and filling their carts. The difference is in the choices they make. Grocery bills are climbing, but consumers aren’t pulling back. Instead, they are reorganizing priorities, stretching every dollar, scrutinizing value on every shelf and screen, and finding new ways to make their budgets work.

Across generations, we’re seeing major shifts.

Customers are trading down to lower-cost brands on a weekly basis, leveraging sales and coupons, especially in the commodity categories. Value channels are growing, with wholesale clubs, dollar formats, discount retailers, and private label gaining across income brackets.

Meanwhile small indulgences are thriving. The “treat yourself” culture is alive and well, as Gen Z and Millennials seek low-cost emotional lifts, from premium coffee to personal care.

Small treats come as discretionary spending is being delayed. Furniture, vacations, and big-ticket items are “wait until later” purchases, unless tariffs threaten additional price hikes, which can trigger early purchases. Side hustles and fintech tools have become mainstream. Two out of five consumers now supplement income outside their primary job, and half use loyalty, rewards, or cashback tools.

Confidence is low, volatility is high, and consumers are adjusting faster than ever. They’re not pulling back, but reorganizing priorities, trading down, leaning into value channels, and finding ways to keep small indulgences alive. This adaptability isn’t a blip; it’s a lasting behavior shift.

For CPG brands, the takeaway is clear: pivot with consumers or risk losing share. Every decision, from pricing to packaging, needs to reflect how people shop now—value-driven, transparency-focused, and ready to switch if brands don’t deliver.

Based on our research and what we’re hearing from partners across the industry, here’s are a few considerations.

- Design for clarity, value and trust. If your pack doesn’t communicate value, purpose, and recognition in three seconds, you lose the sale.

- Deliver affordable joy. Small indulgences are outperforming. Lean into them with seasonal items, low-cost bundles and discovery-driven SKUs.

- Treat compliance as a competitive advantage. Regulation is tightening globally. Smart packaging changes can build credibility, profitability and not just meet requirements.

- Re-evaluate materials through a cost and carbon lens. With tariffs elevating material costs, this is the moment to revisit glass-to-plastic shifts, lightweighting, or re-engineering.

The Bottom Line

The consumer landscape isn’t weakening; it’s transforming. Confidence is low, but participation is high. People are aware and spending, but differently. Brands are being watched, evaluated, and compared more closely than ever.

In uncertain times, packaging becomes a strategy, not just an expense line. CPG companies that treat packaging as a strategic lever, not a cost, will be the ones that win.

The question isn’t whether consumers or the economy is changing, it’s whether your brand is evolving fast enough to meet them in the center of this perfect storm.